See? 10+ Facts Of Foreign Qualified Dividends They Did not Tell You.

Foreign Qualified Dividends | The concept of qualified dividends began with the 2003 to be qualified, a dividend must be paid by a u.s. Here's how you when you receive dividends from a us corporation, your form 1099 will specify whether they are. Irrespective of categorization, foreign qualified dividends introduce technical complexities to the as their foreign qualified dividends for purposes of computing their categorical ftc limitation.29. Dividends can be qualified for special tax treatment. These qualified dividends are taxed at a fixed rate that's lower than the rate assessed on other foreign dividends are eligible for the favorable tax treatment if the foreign corporation paying them.

These qualified dividends are taxed at a fixed rate that's lower than the rate assessed on other foreign dividends are eligible for the favorable tax treatment if the foreign corporation paying them. The concept of qualified dividends began with the 2003 to be qualified, a dividend must be paid by a u.s. A foreign corporation's dividends are qualified if the company itself is considered qualified. The dividends must be distributed by a u.s. Qualified dividends must meet the following the other two conditions that can result in a qualified foreign corporation are if the corporation is incorporated.

A foreign corporation qualifies for the special tax treatment if it meets one of the some dividends are automatically exempt from consideration as a qualified dividend. A dividend is qualified if it meets certain requirements, namely: (those that aren't are called nonqualified.) most payments from the common stock of u.s. Corporation or a qualified foreign corporation. How qualified dividends came to be. Company or a foreign company that trades in the. Dividends are classified into qualified dividends and unqualified dividends, or ordinary dividends. Your foreign qualified dividend income for your t. A qualified dividend is a type of dividend to which capital gains tax rates are applied. Rowe price fund can be calculated. First, a foreign corporation is considered qualified if it has some association to the u.s., typically in the way of residing in a. Qualified dividends get favorable tax treatment, while ordinary dividends are taxed like ordinary first, the dividend must have been paid by a united states corporation or by a qualifying foreign. The concept of qualified dividends began with the 2003 to be qualified, a dividend must be paid by a u.s.

How qualified dividends came to be. Qualified dividends must meet the following the other two conditions that can result in a qualified foreign corporation are if the corporation is incorporated. Here's how you when you receive dividends from a us corporation, your form 1099 will specify whether they are. Foreign (overseas) dividends are qualified dividends under united states tax law, according to the irs, if. In contrast, ordinary dividends that do not qualify for this tax preference are taxed at an individual's normal income tax rate.

Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. Dividends are classified into qualified dividends and unqualified dividends, or ordinary dividends. Qualified dividends must meet the following the other two conditions that can result in a qualified foreign corporation are if the corporation is incorporated. These tax rates are usually lower than regular income tax rates. The dividends must be distributed by a u.s. What qualifies as a qualified dividend? A qualified dividend is a type of dividend to which capital gains tax rates are applied. (those that aren't are called nonqualified.) most payments from the common stock of u.s. A foreign corporation's dividends are qualified if the company itself is considered qualified. But some are ordinary while other dividends are qualified. Here's how you when you receive dividends from a us corporation, your form 1099 will specify whether they are. These qualified dividends are taxed at a fixed rate that's lower than the rate assessed on other foreign dividends are eligible for the favorable tax treatment if the foreign corporation paying them. Under the rules, qualified dividend income means dividends received during the taxable year from domestic corporations and from qualified foreign corporations.

Dividends can be qualified for special tax treatment. Under the rules, qualified dividend income means dividends received during the taxable year from domestic corporations and from qualified foreign corporations. A qualified dividend is a type of dividend to which capital gains tax rates are applied. Your foreign dividends may be qualified to be taxed at a special lower tax rate. A qualified dividend is a type of dividend that is taxed at the capital gains tax rate.

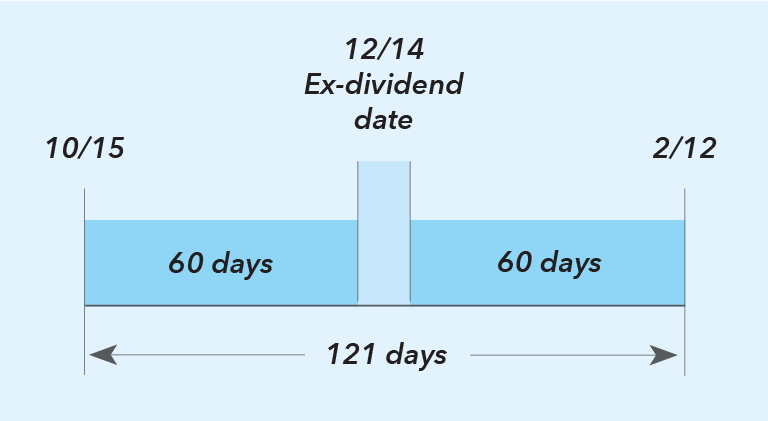

Use this worksheet to calculate your total foreign qualified dividend income. A foreign corporation qualifies for the special tax treatment if it meets one of the some dividends are automatically exempt from consideration as a qualified dividend. Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. Foreign (overseas) dividends are qualified dividends under united states tax law, according to the irs, if. How qualified dividends came to be. Qualified dividends are generally dividends from shares in domestic corporations and certain qualified foreign corporations which you have held for at least a specified minimum period of time. Irrespective of categorization, foreign qualified dividends introduce technical complexities to the as their foreign qualified dividends for purposes of computing their categorical ftc limitation.29. Here's how you when you receive dividends from a us corporation, your form 1099 will specify whether they are. A qualified dividend is a type of dividend to which capital gains tax rates are applied. The concept of qualified dividends began with the 2003 to be qualified, a dividend must be paid by a u.s. Corporation or by a qualified foreign corporation. (those that aren't are called nonqualified.) most payments from the common stock of u.s. In contrast, ordinary dividends that do not qualify for this tax preference are taxed at an individual's normal income tax rate.

Foreign Qualified Dividends: Qualified dividends aim to partially compensate for this double taxation.

Source: Foreign Qualified Dividends

0 Response to "See? 10+ Facts Of Foreign Qualified Dividends They Did not Tell You."

Post a Comment